SOC audit services are professional check-ups performed by independent CPA firms to verify a company’s internal controls, especially around data security and reliability. Think of it as a rigorous home inspection for your digital house. It gives your enterprise customers critical proof that you’re managing their sensitive data the right way.

What Are SOC Audit Services and Why They Matter for Growth

At its heart, a System and Organization Controls (SOC) audit is an independent stamp of approval showing you have the right safeguards to protect customer data. It’s not just a technicality; it’s a cornerstone of business trust. If your company stores, processes, or touches customer information—especially if you’re in SaaS, FinTech, or HealthTech—a SOC report is the universal language of security.

The audit measures your internal controls against standards set by the American Institute of Certified Public Accountants (AICPA). The report you get at the end gives clients a transparent look at your operations, turning vague promises about security into concrete, verified proof.

Beyond a Compliance Checkbox

Seeing a SOC audit as just another compliance checkbox is a huge mistake. The real power of a SOC report is its ability to unlock business growth. For many enterprise customers, SOC 2 compliance isn’t a “nice-to-have”—it’s a non-negotiable prerequisite before they’ll even consider signing a contract. Without one, your sales team will keep hitting dead ends with high-value deals.

A clean SOC report is a powerful sales and marketing asset. It proactively answers the security questions that every enterprise buyer has, shortening sales cycles and removing significant friction from the due diligence process.

Completing an audit successfully shows you have a mature security posture, which leads directly to real business benefits.

- Accelerating Enterprise Deals: A SOC report often satisfies the intense vendor security questionnaires that big companies require, cutting down procurement time.

- Unlocking New Markets: Trying to break into heavily regulated industries like finance and healthcare is nearly impossible without a recognized security report.

- Building Enduring Trust: It offers objective proof that you’re a responsible steward of customer data, which strengthens relationships and your brand’s reputation.

The demand for this kind of assurance is exploding. The global market for SOC reporting services hit USD 5,392 million and is expected to climb to USD 10,470 million by 2030. This reflects the intense pressure on tech companies to back up their security claims with real evidence. For a deeper look at the process and why it’s so critical for growth, this comprehensive SOC 2 audit guide is a great resource. You can also explore more on the market’s explosive growth and other insights on SOC reporting market trends.

Navigating the Different Types of SOC Reports

Jumping into the world of SOC audits can feel like learning a new language. You’ve got SOC 1, SOC 2, SOC 3—what’s the difference? Getting this right is the first, and most important, step.

Think of these reports like different types of security clearances. Each one grants you access to a different kind of customer or market, and you need the right one for the job. Choosing the wrong report is a classic rookie mistake that wastes a ton of time and money on an audit that your customers won’t even accept. But nail the right one, and you’ll start unlocking bigger deals and building serious trust.

SOC 1 for Financial Controls

A SOC 1 report is all about the money. Specifically, it’s for service organizations whose operations could mess with their clients’ financial statements. If your service is a critical part of your customer’s financial reporting chain, you’re going to need a SOC 1. The official term for what it covers is Internal Control over Financial Reporting (ICFR).

Let’s say you run a payroll processing company. Your service directly impacts your clients’ books—salary expenses, tax liabilities, you name it. When it’s time for your clients to go through their own financial audits, their auditors will demand proof that your internal controls are solid. Your SOC 1 report is that proof.

- Who it’s for: Payroll processors, claims administrators, loan servicers, and any business that touches a client’s financial data.

- What it proves: That your internal controls are designed and working effectively to prevent mistakes that could ripple out into your clients’ financial statements.

SOC 2 for Technology and Data Security

The SOC 2 report has become the undisputed gold standard for tech companies. If you’re a SaaS provider, data center, or managed service provider, this is your report. Unlike the financial focus of SOC 1, a SOC 2 audit measures your controls against the AICPA’s five Trust Services Criteria.

These criteria are essentially a rulebook for how to handle customer data responsibly. They give your customers assurance that you’re not just winging it when it comes to security and reliability.

- Security (Common Criteria): This one is mandatory. It’s the foundation of every SOC 2 and covers how you protect systems from unauthorized access.

- Availability: Proves your system is up and running when you promise it will be. Crucial for services that can’t afford downtime.

- Processing Integrity: Ensures your system does what it’s supposed to do—completely, accurately, and on time. Think financial transaction platforms.

- Confidentiality: This is about protecting data that is specifically marked as “confidential.”

- Privacy: Addresses how you handle personal information (PII), from collection and use to disposal.

If you store or process any kind of sensitive customer data, enterprise prospects will absolutely ask for your SOC 2. It’s non-negotiable. To get a deeper look at how these two reports stack up, check out the key differences between SOC 1 and SOC 2 reports.

To make it even clearer, here’s a quick breakdown to help you figure out which report aligns with your business.

SOC Report Quick Comparison Guide

| Attribute | SOC 1 | SOC 2 | SOC 3 |

|---|---|---|---|

| Primary Focus | Internal controls over financial reporting (ICFR) | Security, Availability, Processing Integrity, Confidentiality, and Privacy | High-level summary of SOC 2 controls |

| Audience | Customer’s auditors and management | Customer’s management, security teams, and regulators (under NDA) | Public, customers, prospects, and partners |

| Use Case | Assuring clients about financial control integrity | Demonstrating robust data security and operational practices | Marketing, building public trust, website trust seals |

| Content Detail | Detailed description of controls, tests, and results | Detailed description of controls, tests, and results | General summary of the audit; no detailed test results |

| Distribution | Restricted use; requires NDA | Restricted use; requires NDA | General use; freely distributable |

Choosing the right report comes down to a simple question: What are your customers trying to verify? If it’s about financial integrity, you need a SOC 1. If it’s about data security and operational trust, it’s SOC 2. And if you want to shout that trust from the rooftops, you get a SOC 3.

SOC 3 for Public Assurance

Last but not least, we have the SOC 3 report. This is essentially a public-friendly, summarized version of your SOC 2 audit. It provides a high-level seal of approval without diving into the nitty-gritty details of your controls or the auditor’s specific tests. This makes it a fantastic marketing tool.

A SOC 3 report is the public version of your SOC 2. It’s designed to live on your website’s trust center or in sales materials. It offers a quick, easily digestible sign of your commitment to security without revealing sensitive operational details.

Because a SOC 3 contains no confidential information about your internal workings, you can share it freely. It even comes with an official seal from the AICPA, giving you a credible and powerful asset for building trust with the broader market before you even get into a sales conversation.

Understanding Type 1 and Type 2 Reports

Once you’ve landed on the right SOC report for your business, you hit your next big decision: Type 1 or Type 2? This is a common point of confusion, but the concept is actually pretty simple.

Think of a Type 1 report as a single photograph. It captures the design of your security controls at one specific moment in time. It basically answers the question, “On this particular day, did we have the right controls in place?”

A Type 2 report, on the other hand, is like a full-length movie. It doesn’t just look at the design of your controls; it proves they have been operating effectively over a sustained period, usually six to twelve months. This gives your customers a much, much deeper level of trust.

Type 1: The Point-in-Time Snapshot

A Type 1 report is often a smart first move for companies just dipping their toes into the SOC audit world. It’s faster and less of a resource drain, so you can get an initial report into a customer’s hands quickly. This is a big help for startups trying to satisfy an urgent request or just get a baseline read on their security setup.

But let’s be real—its value is limited. Since it only confirms your controls were designed properly on a single day, it offers zero proof that anyone is actually following them. For most enterprise buyers, a Type 1 report just doesn’t cut it.

Type 2: The Gold Standard for Assurance

The Type 2 report is where real trust is built. By testing your controls over several months, it demonstrates that you have a mature and consistent security program. This is the report that sophisticated enterprise buyers and clients in regulated industries will demand.

A SOC 2 Type 2 report is the non-negotiable proof that your security program is not just a policy on paper, but a living, breathing part of your daily operations. It’s the difference between saying you have a security system and proving it works day in and day out.

When you’re evaluating your own vendors or hosting partners, it’s critical to ask about the availability of a SOC 2 Type 2 report. It’s a key signal of how seriously they take security. That long-term evidence is what unlocks the biggest deals and builds lasting customer confidence.

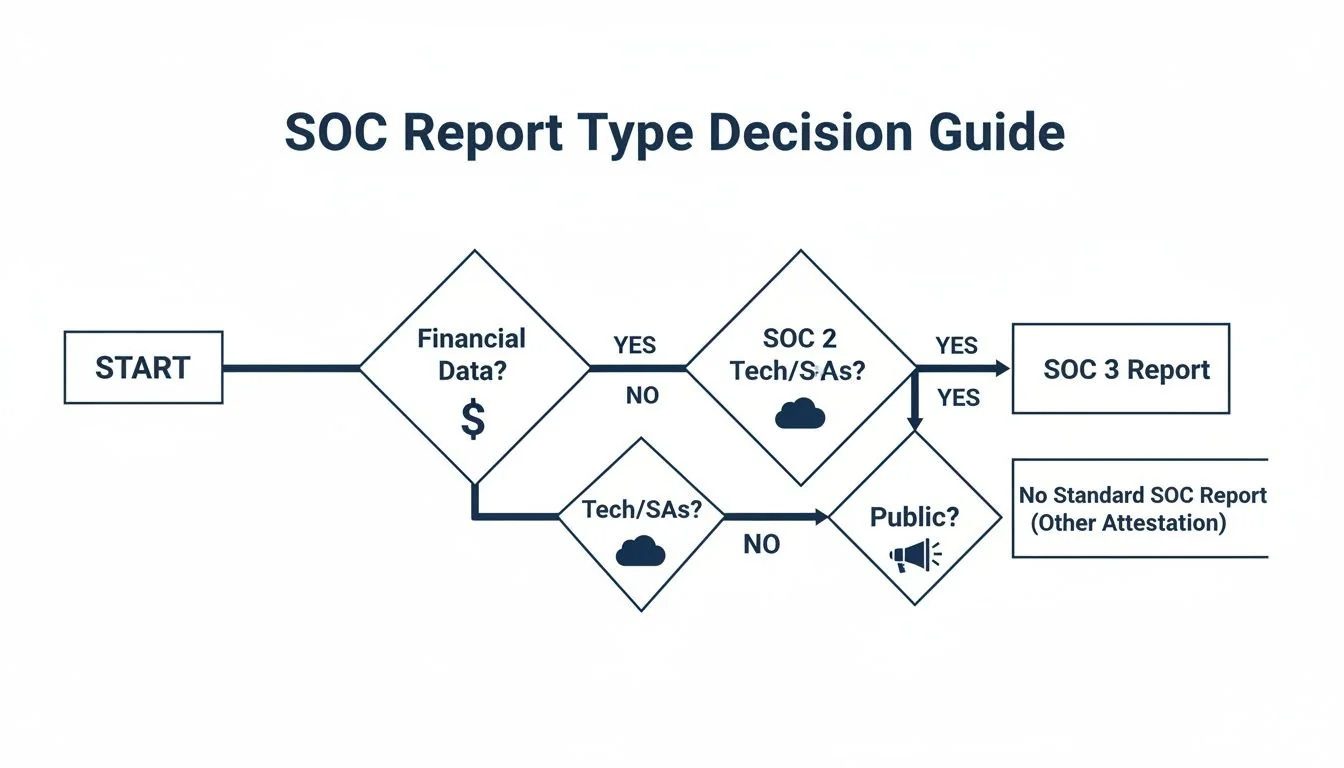

This decision tree can help you visualize which SOC report type is the best fit for your company’s services and customers.

As the flowchart shows, what your service actually does—whether it touches financial reporting or handles sensitive customer data—is the main factor driving which report you’ll need.

Making the Right Business Decision

Choosing between Type 1 and Type 2 isn’t just a compliance task; it’s a strategic call that will directly affect your sales cycle and team’s workload. Here’s a quick rundown to help you think it through:

- Speed and Cost: Type 1 is way faster and cheaper. It’s a solid option if you need an initial report, and you need it now.

- Customer Acceptance: Type 2 provides a much higher level of assurance and is a hard requirement for most large enterprises, especially in industries with heavy regulation. A Type 1 might get you in the door, but a Type 2 is what closes the deal.

- Internal Effort: That observation period for a Type 2 audit isn’t passive. It demands sustained effort from your team to consistently operate, document, and prove your controls are working.

Ultimately, while a Type 1 can be a useful stepping stone, the end goal for most growing tech companies is to achieve a Type 2 report. For a deeper dive, you can learn more about what is a SOC 2 Type 2 report and why it’s so important for your business.

Your Step-by-Step SOC Audit Process

Starting a SOC audit can feel like planning a major expedition. You know where you want to end up—with a clean report in hand—but the path forward seems complex and full of potential pitfalls. The key is to break the journey down into manageable stages.

A good SOC audit engagement follows a logical, five-phase progression. It moves from high-level planning all the way down to the final, detailed report. Understanding each phase helps you set realistic timelines, assign the right people, and keep the whole process from going off the rails.

Phase 1: Scoping and Readiness Assessment

This first step is everything. Seriously. It’s where you draw the map for the entire audit. Rushing through scoping is one of the most common and costly mistakes a company can make, often leading to auditing the wrong things or uncovering massive problems way too late.

First, you’ll work with your audit firm to define the scope. This just means deciding exactly which systems, services, data centers, and Trust Services Criteria will be under the microscope. A tight scope ensures you’re not burning time and money auditing irrelevant controls, while still giving your customers the assurance they need.

Next up is the readiness assessment. Think of this as a dress rehearsal. Your auditor acts more like a consultant, reviewing your existing controls against the SOC 2 criteria to find gaps before the real audit begins. This is your golden opportunity to fix problems without the risk of them showing up as formal exceptions in your report. It’s a big deal—industry data shows that companies completing a readiness assessment are 70% less likely to have major issues during their official audit.

Phase 2: Evidence Collection

Once you’ve shored up your controls, it’s time to prove they’re actually working. For your internal team, this is usually the most labor-intensive part of the audit. Your auditor will hand over a list of evidence they need to see, and your team is on the hook for gathering it all.

This evidence can be a mix of all sorts of things:

- Policies and Procedures: Documents like your information security policy or your plan for handling incidents.

- System Configurations: Screenshots showing how you’ve configured security settings in your cloud environment.

- Access Logs: Records that prove only authorized people are getting into sensitive systems.

- Meeting Minutes: Notes from your security team meetings or annual risk assessments.

This is where compliance automation platforms like Vanta or Drata become invaluable. They can plug directly into your systems (like AWS, Google Cloud, or Azure) and automatically pull much of this evidence, saving your engineering team hundreds of hours of manual work. For a Type 2 audit, this collection phase runs throughout the entire observation period, which is typically six to twelve months.

The evidence collection phase is where the rubber meets the road. It transforms your security policies from theoretical documents into tangible, verifiable proof of your commitment to protecting customer data.

Phase 3: Auditor Testing and Fieldwork

With all the evidence gathered, your auditor now takes center stage. This is the “audit” part of the SOC audit. They will meticulously review every piece of documentation and perform their own tests to make sure your controls are solid.

Here’s what the auditor is actually doing:

- Reviewing Evidence: Scrutinizing the policies, logs, and screenshots your team provided.

- Conducting Interviews: Talking to key people, like your CTO or Head of Security, to understand how processes really work day-to-day.

- Performing Sample Testing: For example, they might pick a handful of new hires to verify that your employee onboarding and access controls were followed correctly for each one.

For a Type 1 report, this testing just confirms the design of your controls at a single moment. For a Type 2, the testing is far more rigorous, validating that your controls operated effectively over the entire review period.

Phase 4: Remediation and Draft Reporting

It’s pretty common for an auditor to find a few minor issues or “exceptions” during testing. Don’t panic—this doesn’t mean you’ve failed. This is what the remediation phase is for.

Your auditor will flag any issues they’ve found, and your team gets a chance to fix them. This might mean updating a policy, tweaking a system configuration, or just providing some extra evidence to clear things up.

Once you’ve addressed the findings, the auditor prepares a draft of the SOC report. Your management team gets to review this draft to make sure the description of your company and its systems is accurate before the final version is locked in.

Phase 5: Final Reporting and Delivery

This is the finish line. The auditor issues the official SOC report—a comprehensive document that includes their professional opinion, your management’s assertion, a detailed description of your environment, and the results of all the control tests.

The goal is to receive an “unqualified opinion.” This is the best possible outcome, meaning the auditor found your controls to be well-designed (for Type 1) and operating effectively (for Type 2) without any major exceptions. This final report is the asset you can share with enterprise customers (under an NDA, of course) to build trust and shorten your sales cycles.

How to Choose the Right SOC Auditor

Picking the right partner for your SOC audit services is one of the most important calls you’ll make in your compliance journey. This isn’t just about hiring a firm to check a few boxes. It’s about finding a genuine advisor who can navigate you through what is often a pretty complicated process.

Get it right, and you turn a compliance headache into a real business advantage. Get it wrong, and you’re looking at blown budgets, missed deadlines, and a final report that fails to impress the very customers you’re trying to win.

The stakes are higher than ever. With 92% of organizations now running at least two compliance audits every year, SOC 2 consistently lands in the top three. This isn’t just internal pressure; it’s driven by the market. Consider that 60% of companies prefer buying from startups that are already SOC 2 certified, and a whopping 70% of venture capitalists look for it before they’ll even consider an investment. You can dig into more of these compliance statistics and trends to see just how critical this has become.

Key Evaluation Criteria for Your Auditor

So, how do you move beyond the generic sales pitches and actually compare audit firms? You need a solid framework. Focusing on a few key areas will tell you everything you need to know about the quality of the experience and the value of the final report.

Here’s what really matters:

- Deep Industry Specialization: Does the firm actually get your business? An auditor who spends their days in manufacturing plants won’t understand the risks of a multi-tenant SaaS platform. You need a partner who speaks your language and understands your tech stack inside and out.

- Report Clarity and Usability: A SOC report crammed with dense, technical jargon is totally useless to your sales team. A great auditor delivers a report that’s clear, well-organized, and can be handed to a prospect to build confidence and speed up the deal cycle.

- Pricing Transparency: Nothing sours a relationship faster than hidden fees and surprise charges. Demand a clear, all-inclusive quote that breaks down the cost for every phase, from readiness to the final report. Ask them straight up: what happens if we need remediation help?

- Support and Responsiveness: You’re going to have a million questions during the audit. A responsive partner who gives you clear, timely answers is worth their weight in gold. Don’t be shy—ask for client references and check their satisfaction scores to see how they really treat their customers.

Boutique Firm vs. The Big Four

One of the first big decisions you’ll face is whether to go with a massive, household-name firm (think Deloitte or PwC) or a smaller, specialized boutique auditor. Each path has its own distinct pros and cons.

The Big Four and Large National Firms

- Pros: Their brand recognition is unmatched, which can add a certain gravitas to your report. They have enormous resources and deep experience with huge, global companies.

- Cons: They are almost always significantly more expensive and far less flexible. To them, your company might just be another small account, which can translate to less personalized attention.

Specialized Boutique Audit Firms

- Pros: These firms are typically more cost-effective and agile. They often possess deep expertise in specific niches like SaaS or FinTech and deliver a much more hands-on, partnership-focused experience.

- Cons: Their brand might not carry the same immediate weight as a Big Four firm, though savvy enterprise buyers are caring less and less about this.

For most startups and mid-market tech companies, a specialized boutique firm offers the best balance of expertise, cost, and personalized service. They are built to serve companies like yours, not just Fortune 500 giants.

Finding that perfect-fit auditor can feel like a full-time job of researching, emailing, and sitting through endless vetting calls. This is where comparison platforms can be a game-changer. For example, our guide on the top SOC 2 audit firms is a great place to kick off your research.

To make this process less of a guessing game, here’s a checklist to help you systematically evaluate and compare your options.

Auditor Selection Checklist Key Decision Factors

| Evaluation Criteria | Why It Matters | Questions to Ask |

|---|---|---|

| Industry Expertise | An auditor who knows your industry (e.g., SaaS, FinTech) understands your risks and can provide relevant guidance, leading to a smoother, more efficient audit. | ”How many companies in our industry have you audited in the last year?” “Can you provide references from clients with a similar tech stack?” |

| Responsiveness & Support | Slow communication can delay your audit by weeks or months. You need a partner who answers questions quickly and provides clear guidance when you’re stuck. | ”What is your typical response time for client emails during an audit?” “Who will be my dedicated point of contact?” |

| Pricing & Transparency | Hidden fees and surprise “change order” costs are common. A transparent quote prevents budget overruns and ensures a predictable financial commitment. | ”Is this an all-inclusive quote? What services might incur additional fees?” “What happens to the cost if we need to remediate findings?” |

| Audit Methodology & Tech | Modern auditors use technology to streamline evidence collection, reducing the manual burden on your team. An outdated process means more work for you. | ”What platform do you use for evidence collection and project management?” “Does your platform integrate with GRC tools like Vanta or Drata?” |

| Report Usability | The final report is a sales tool. It needs to be clear and easy for non-technical stakeholders (like your customers’ legal teams) to understand and accept. | ”Can you provide a redacted sample report?” “How do you ensure the report is clear and useful for our sales team?” |

| Team Experience | The experience of the specific individuals on your audit team matters more than the firm’s overall brand. High turnover can lead to you re-explaining your business year after year. | ”Who will be on our engagement team? What is their experience level?” “Do you guarantee team continuity for our annual surveillance audits?” |

Using a structured checklist like this ensures you’re making a decision based on data, not just a sales pitch. It forces a direct comparison on the factors that will actually impact your experience.

Comparison platforms take this a step further by laying out the data for you.

This kind of side-by-side view lets you instantly compare critical factors like pricing, typical timelines, and client satisfaction scores without having to schedule a dozen sales calls. This data-driven approach removes the guesswork and helps you quickly shortlist partners who truly line up with your budget, timeline, and business goals. Platforms like SOC2Auditors.org are designed to provide exactly this clarity, turning a complex, frustrating search into a structured, confident decision.

Your Top SOC Audit Questions, Answered

When you’re staring down the barrel of a compliance audit, a lot of practical questions come up. Let’s cut through the noise and get straight to the answers on what this will actually cost, how long it will take, and the common traps to avoid.

How Much Does a SOC 2 Audit Actually Cost?

There’s no single price tag for a SOC 2 audit. The cost really depends on your company’s size, how complex your systems are, and which report you’re going for. For a smaller company, a Type 1 audit typically falls between $15,000 and $30,000.

A Type 2 audit is a bigger lift, usually costing between $25,000 and $70,000, since it involves a longer observation period and much more testing. For larger businesses or those with a ton of systems in scope, the price can easily shoot past $100,000. Keep in mind, these numbers don’t include separate costs for things like readiness assessments or compliance automation software, which are smart investments to bake into your budget.

How Long Does the Entire SOC Audit Process Take?

The timeline is a direct result of the report type you choose and how ready you are to begin with. A Type 1 audit can be wrapped up in 2 to 4 months, especially if you already have your controls well-documented and in place. It’s the faster route if you need a report in hand quickly.

A Type 2 audit is a different beast. It demands an observation period where the auditor watches your controls in action, which typically lasts between 6 and 12 months. Because of that, the entire Type 2 process—from the first kickoff meeting to getting the final report—can take anywhere from 7 to 15 months.

A thorough readiness assessment is the single best way to speed things up. Identifying and fixing control gaps before the official audit starts is the secret to preventing major delays and ensuring a much smoother process.

What Are the Most Common Pitfalls to Avoid?

I’ve seen three common mistakes completely derail a company’s first audit. They lead to wasted time, blown budgets, and a report that doesn’t quite hit the mark.

-

Poor Scoping: This is a classic, critical error. Auditing too much adds a ton of unnecessary cost and complexity. Auditing too little means the report won’t give your customers the assurance they actually need. You have to work closely with your auditor to define a scope that is both meaningful and manageable.

-

Underestimating Internal Effort: You can’t just hand this off to an auditor and wash your hands of it. A SOC audit requires a significant time commitment from your own team—from engineering to HR—to gather evidence and work with the auditors. It is absolutely essential to assign a clear internal project owner to keep the train on the tracks.

-

Skipping a Readiness Assessment: Diving straight into an audit without any prep is, by far, the biggest mistake you can make. This almost always leads to nasty surprises, like failed controls, huge delays, and a “qualified” report. A qualified opinion can seriously damage customer trust instead of building it.

Finding the right auditor at the right price can feel like an endless cycle of sales calls and confusing quotes. We built SOC2Auditors to fix that. Our platform replaces the guesswork with simple, data-driven matching. Compare 90+ verified firms on price, timeline, and client satisfaction to find your perfect SOC audit partner in minutes. Get your tailored matches at https://soc2auditors.org.