Let’s be blunt: a SOC 2 Type 2 audit isn’t cheap. The auditor’s fee alone typically runs between $20,000 and $60,000. But that’s just one piece of the puzzle. The total program cost—which includes everything from readiness to tools to your team’s time—often lands somewhere between $30,000 and $150,000, and can easily climb higher.

Decoding Your SOC 2 Type 2 Audit Cost

When you ask about the cost of a SOC 2 audit, you’re not just buying a report off the shelf. You’re funding a major business initiative, and the final price tag is a sum of several distinct parts.

Thinking you just need to hire an auditor is a common mistake. The reality is that the audit itself is the final step. The real work—and a significant chunk of the cost—comes from getting your organization ready, implementing the right controls, and proving they actually work over a period of time.

The Major Cost Components

To build a realistic budget, you need to see the whole picture. The money you spend on a SOC 2 Type 2 program almost always falls into four main buckets:

- Readiness Assessment: This is your pre-flight check. It’s where you find all the gaps in your security posture before the auditor starts their clock. Skipping this is a recipe for expensive surprises down the road.

- Auditor Fees: This is the most obvious expense—the direct payment to the CPA firm for conducting the audit and writing the final report. It’s a big number, but it’s far from the only one.

- Compliance Tools & Software: Platforms like Vanta or Drata are becoming standard. They automate the painful process of collecting evidence and monitoring controls, which saves a massive amount of your team’s time.

- Internal Resources: This is the “hidden” cost of your team’s time. Think of the hours your engineers, IT staff, and HR personnel will spend implementing controls, gathering evidence, and answering auditor questions.

Understanding the Price Spectrum

Why is the price range for SOC 2 so wide? Because it’s not a one-size-fits-all product.

Recent market analysis shows just how much the cost can vary. The auditor’s direct fee can be as low as $7,000 for a tiny startup or over $150,000 for a complex enterprise. Most mid-sized companies land in that $20,000 to $60,000 zone for the audit itself.

But remember, that’s just the auditor. When you add in readiness assessments, penetration tests, monitoring tools, and your team’s time, the total first-year investment for a full program often settles between $30,000 and $150,000. For large, complex organizations, this figure can easily surpass $250,000. For a deeper dive into these numbers, compliance experts at Accedere have published some great 2025 cost breakdowns.

To give you a clearer idea of where your money will go, here’s a quick summary of the potential costs involved.

Quick Summary of Potential SOC 2 Type 2 Costs

| Cost Component | Typical Price Range (Low End) | Typical Price Range (High End) |

|---|---|---|

| Readiness Assessment | $5,000 | $25,000 |

| Auditor Fees | $20,000 | $60,000+ |

| Compliance Automation Software | $7,500 | $20,000+ (per year) |

| Internal Team Time | Varies (significant) | Varies (significant) |

As you can see, the auditor’s fee is only one part of the equation. Budgeting for the entire program from day one is the key to a smooth and predictable SOC 2 journey.

What Really Drives Your Audit Costs?

Figuring out your SOC 2 Type 2 cost isn’t like looking up a price on a menu. It’s more like building a custom house—the final number depends entirely on the blueprint. A cozy cottage costs a lot less than a sprawling mansion, and the same logic applies here.

Every choice you make, from the scope of your report to the firm you hire, has a direct impact on your budget. Let’s break down the core factors that will scale your investment up or down, so you can stop guessing and start planning.

Your Company Size and Complexity

This is the big one. The most fundamental factor is simply the size and complexity of your organization. An auditor’s job is to test your controls, and the more ground they have to cover, the more hours they’ll bill.

Think about it: a small startup with 25 employees and a single cloud-native app is a pretty straightforward audit. Now compare that to a 500-person company with multiple product lines, legacy systems, and several offices. That’s a much more tangled web for an auditor to unravel.

More employees, systems, and locations mean:

- More evidence to collect: Auditors need to sample everything from user access lists to change management tickets. More people and systems mean exponentially more evidence to gather and review.

- More processes to review: If you have separate development teams or business units, each one might have unique workflows that need to be assessed individually.

- More complex testing: A simple AWS setup is one thing. A hybrid environment mixing on-premise servers with multiple cloud providers? That requires way more extensive and time-consuming testing.

The Scope of Your Audit

Right after company size, the scope of your audit is the next major cost driver. This all comes down to which of the five Trust Services Criteria (TSC) you include. While Security (often called the Common Criteria) is mandatory for every SOC 2 audit, the other four are optional.

Each extra Trust Services Criterion you add to your audit is like adding another room to your house. It expands the blueprint, requires more materials (evidence), and increases the labor (auditor hours) needed to finish the job.

Here’s a quick look at how each TSC adds to the workload:

- Availability: The auditor now has to test your business continuity plans, disaster recovery procedures, and system monitoring.

- Confidentiality: This involves digging into data encryption policies, access controls for sensitive information, and how you handle data destruction.

- Processing Integrity: Now the focus is on quality assurance, data validation, and controls that ensure your system does its job without errors.

- Privacy: This adds a deep dive into how you collect, use, and protect personally identifiable information (PII) according to your privacy notice.

Adding just one extra TSC can easily increase your audit fees by 15-30% because it expands the checklist of controls the auditor must test.

Choosing Your Auditing Firm

Finally, the firm you hire can be one of the biggest line items in your budget. Not all CPA firms are the same, and their price tags reflect their brand recognition, size, and way of doing things.

For instance, a boutique or regional CPA firm often provides a much more cost-effective path, with lower baseline rates. On the other hand, a “Big Four” or large national firm is going to charge a serious premium for its brand name—sometimes double the cost for a similar scope.

The numbers back this up. Based on our analysis, small startups often land in the $20,000–$50,000 range for their total Type 2 program. Mid-market companies are more likely to fall between $30,000 and $100,000. And if you’re a large enterprise or working with a Big Four firm, that total cost can easily blow past $150,000, especially with multiple TSCs in the mix. As you look at proposals, you have to compare not just the price, but the real value each firm brings to the table. You can get more insights on auditor pricing over at Compass ITC’s blog.

How Your Timeline Shapes Your Final Budget

In a SOC 2 audit, the clock is always ticking—and it’s directly tied to your final bill. The more time an auditor spends digging into your controls, the more hours they log. It’s that simple. Understanding the different phases of a SOC 2 project is the first step to getting a handle on this critical part of your budget.

A common mistake is thinking the audit is a one-and-done event. It’s not. It’s a multi-stage project, and each phase has its own timeline and costs. A delay in one stage creates a domino effect, pushing back your final report and inflating your total spend.

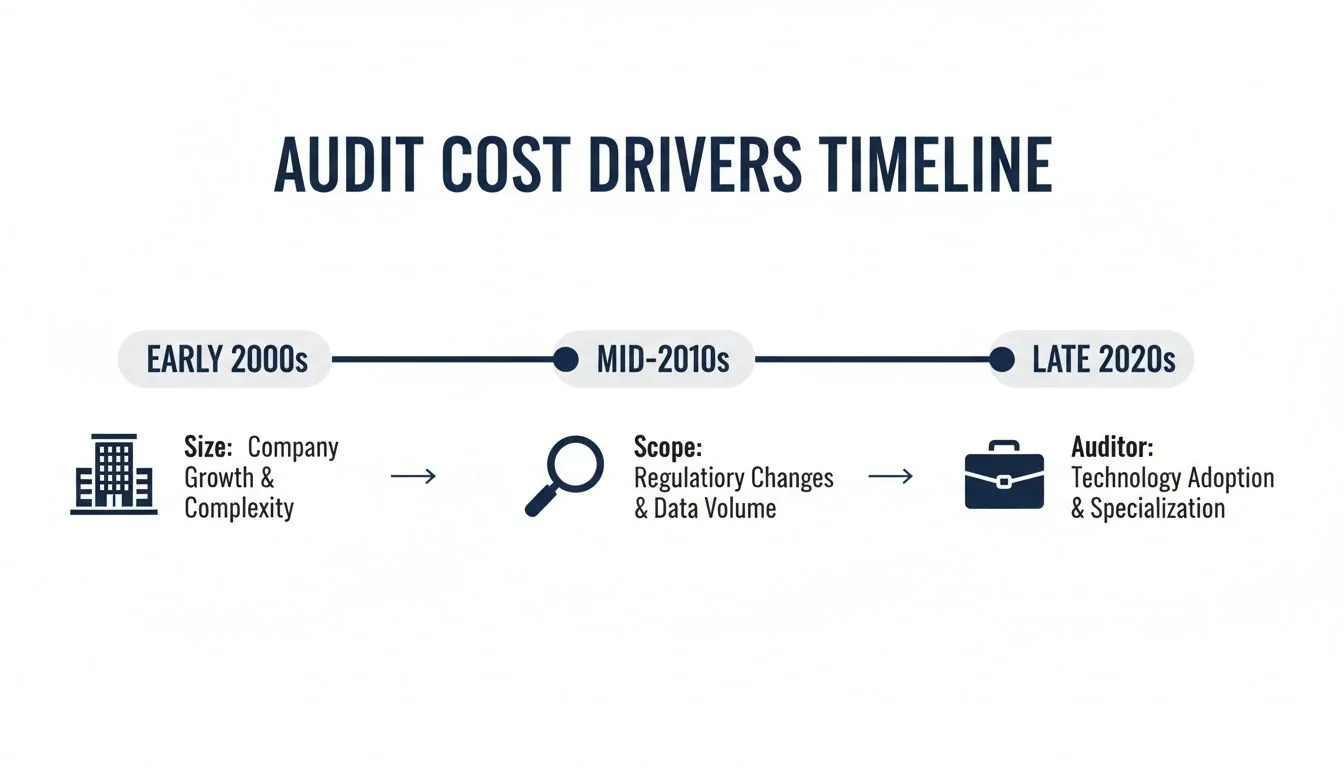

This graphic breaks down how key drivers like your company’s size, the audit’s scope, and your choice of auditor all play together to shape the overall timeline and cost.

As you can see, these factors don’t just add up; they compound, determining just how complex and lengthy your audit will be.

Differentiating the Audit Phases

To manage your budget, you have to think like a project manager. Your SOC 2 journey is typically broken into three distinct periods, each with its own price tag:

- Readiness Phase: This is your prep time. You’ll do a gap analysis to find and fix weak spots in your controls. A solid readiness assessment can take anywhere from one to three months. Finding major gaps here can delay the start of your actual audit, tacking on unplanned costs for remediation.

- Observation Period: For a SOC 2 Type 2 report, auditors have to watch your controls in action over time. This period usually lasts between three and twelve months. A longer window gives customers more assurance, but it also means a lot more testing for your auditor.

- Audit Fieldwork & Reporting: Once the observation period wraps up, the auditor starts their formal testing and report writing. This final sprint usually takes four to eight weeks.

The length of the observation period is one of the biggest levers on your SOC 2 Type 2 audit cost. A 12-month observation period will almost always be more expensive than a six-month one. Why? Because it requires the auditor to sample evidence across a much wider timeframe, often doubling their testing workload.

How the Observation Period Impacts Your Bill

A longer observation window means more work for the auditor. Plain and simple. For a six-month period, an auditor might test user access reviews from two different months. But for a 12-month period, they may need to test samples from four separate months to feel confident in your controls. Every extra sample means more hours spent requesting, reviewing, and documenting evidence.

This direct link between time and cost is why Type 2 audits are so much more expensive than Type 1 reports. The SOC 2 Type 2 reporting period (commonly 3–12 months) is the single biggest driver of that extra auditor effort. It requires far more intensive evidence collection than a point-in-time Type 1 engagement.

If your readiness work uncovers major gaps, the remediation can add months and tens of thousands of dollars to the total cost before the clock on your observation window even starts. To get a better feel for how your company’s specifics might influence pricing, you can play around with our free SOC 2 audit cost tool for a tailored estimate.

By investing in thorough preparation and automating evidence collection, you can set yourself up for a smoother, more efficient audit. Smart planning doesn’t just shorten your timeline; it’s one of the most powerful ways to control your final SOC 2 Type 2 audit cost.

Uncovering the Hidden and Ongoing SOC 2 Costs

That big invoice from your auditor? It feels like the whole cost, but it’s really just the tip of the iceberg. The true SOC 2 Type 2 audit cost is much, much larger, with a whole host of expenses lurking just beneath the surface that can absolutely sink an unprepared budget.

Focusing only on the audit fee is one of the most common—and costly—mistakes we see. To get a real handle on your total investment, you have to account for all the tools, services, and internal time that make a successful audit possible. These aren’t optional nice-to-haves; they’re essential.

The Upfront Investments Beyond the Audit Fee

Long before your auditor sends their first evidence request, you’ll face several major upfront costs. Think of these as the foundational work required to get your security program ready for inspection. Trying to skip this part is like showing up to an exam without studying—it’s a recipe for delays, stress, and a much bigger bill down the road.

Here’s what you’re looking at:

- Remediation Costs: Your readiness assessment will almost certainly find gaps in your controls. Fixing them—whether it’s rolling out a new security tool, rewriting policies, or re-architecting a system—costs real money. This can be a few thousand dollars for small tweaks or tens of thousands if you have major work to do.

- Penetration Testing: While not a mandatory part of every single SOC 2, a “pen test” is a standard expectation, especially if you include the Security TSC. You’ll hire a third-party firm to try and hack your systems to uncover vulnerabilities. A quality pen test will typically run you between $5,000 and $20,000, depending on how complex your environment is.

- Compliance Automation Software: Let’s be honest, asking your engineers to manually gather screenshots and logs for months is a massive waste of their time and talent. That’s why platforms like Vanta or Drata are now the default. Budget anywhere from $7,500 to $20,000+ per year for a subscription.

By far, the most frequently underestimated cost is your team’s own time. The hours your engineers, IT staff, and project leads pour into preparing for and managing the audit represent a very real, very substantial cost that has to be factored in.

SOC 2 Is a Marathon, Not a Sprint

Getting that first SOC 2 report in hand is a huge win. But it’s the starting line, not the finish line. SOC 2 is an ongoing commitment to maintaining your security posture, and your budget has to reflect that reality. The costs don’t just vanish once the report is issued.

Your customers need assurance that your controls are continuously effective, which is why a SOC 2 report is only considered valid for 12 months. This reality transforms what feels like a one-time project into a recurring operational expense, just like payroll or your cloud bill.

This annual cycle means you need a long-term plan for a whole set of recurring costs just to maintain your compliance.

Planning for the Annual Grind

To build a sustainable compliance program, you have to budget for the expenses that will hit your books every single year. These aren’t surprises; they are the new normal for any company with a SOC 2 report.

To help you get a complete picture, we’ve put together a checklist of the most common hidden and ongoing costs that go beyond the auditor’s primary fee.

Checklist of Hidden and Ongoing SOC 2 Program Costs

| Expense Category | Description | Estimated Cost Range |

|---|---|---|

| Annual Renewal Audits | The full SOC 2 Type 2 audit must be performed every 12 months. Renewal audits are sometimes slightly cheaper, but it’s safest to budget a similar amount. | $15,000 - $75,000+ |

| Compliance Software | Annual subscription fees for your automation platform (Vanta, Drata, etc.) to continuously monitor controls and collect evidence. | $7,500 - $20,000+ |

| Security Tooling | Renewals for essential tools like vulnerability scanners, endpoint detection and response (EDR), and security information and event management (SIEM) systems. | $5,000 - $50,000+ |

| Penetration Testing | Most companies perform a pen test annually to meet customer expectations and identify new vulnerabilities. | $5,000 - $20,000 |

| Employee Training | Subscription costs for security awareness training platforms and the time spent on regular training for all employees, especially new hires. | $1,000 - $10,000 |

| Internal Labor | The “time tax” on your team for ongoing evidence management, quarterly access reviews, vendor assessments, and audit participation. | 200-500+ hours |

By planning for these hidden and recurring expenses from the start, you can build a realistic, multi-year budget that truly reflects the total SOC 2 Type 2 audit cost. This proactive approach ensures no financial surprises derail your compliance journey down the road.

Smart Strategies to Reduce Your SOC 2 Audit Expenses

Knowing what drives your SOC 2 costs is one thing; actually controlling them is another. While a proper audit is always an investment, you can use a few proactive strategies to bring that final number down significantly—without cutting corners on the quality of your report.

The trick is to shift from a reactive stance to a strategic one. Don’t just get a quote and brace for impact. Instead, make deliberate choices that make life easier for both your team and your auditor. This turns compliance from a painful cost center into a much more efficient and predictable part of doing business.

Right-Size Your Audit Scope

The fastest way to blow up your SOC 2 Type 2 audit cost is to add Trust Services Criteria (TSC) you don’t actually need. It might feel impressive to go for all five TSCs, but it’s a huge mistake if they aren’t relevant to your services or what customers are asking for.

Start with the basics: the mandatory Security criterion. Period. Then, sit down with your sales team and key customers to figure out what else is absolutely essential to close deals. Adding Availability or Confidentiality should be a direct response to market demand, not a “just-in-case” move that bloats your audit fees.

Invest in a Thorough Readiness Assessment

Jumping into an audit unprepared is a recipe for a very expensive headache. A formal readiness assessment is your pre-audit game plan. It’s designed to find all the control gaps, process weaknesses, and documentation holes before the auditor’s meter starts running.

Fixing problems during the readiness phase is exponentially cheaper than having an auditor find them mid-audit. When an auditor uncovers a major control failure during their fieldwork, it can trigger expensive re-testing, painful delays, and maybe even a qualified opinion on your report.

Think of a readiness assessment as a dress rehearsal. It gives you a low-stakes environment to find and fix every mistake, ensuring that when the main performance begins, your processes are flawless and your evidence is organized.

Spending $5,000 to $20,000 on a good assessment can easily save you double that in remediation costs and wasted auditor hours later. To get a better sense of what this entails, check out our detailed guide on the benefits of a SOC 2 readiness assessment.

Leverage Compliance Automation Tools

Manually gathering evidence for a SOC 2 audit is a soul-crushing, error-prone job that sucks up hundreds of hours from your best engineers. Compliance automation platforms were built to kill this manual work and bring some serious efficiency to the process.

These platforms plug right into your tech stack (think AWS, GitHub, Jira) and get to work. They:

- Continuously monitor controls in real-time, flagging issues long before they become audit problems.

- Automate evidence collection, pulling the logs, configurations, and screenshots you need without anyone lifting a finger.

- Provide a central dashboard for your team and the auditor, which makes reviewing evidence ridiculously simple.

Sure, these platforms have an annual subscription fee, but the ROI is a no-brainer. They slash the internal time spent on audit prep by up to 80% and often lead to lower fees from auditors, who can get their work done much, much faster.

Negotiate Multi-Year Audit Agreements

Auditors, like any business, love predictable, long-term relationships. Once you find a firm you click with, ask about signing a multi-year deal for your annual renewal audits. Firms are often happy to offer a 10-20% discount on future audits to lock in your business.

This isn’t just about saving money; it builds continuity. Your auditor gets to know your environment better every year, which means a smoother, more efficient audit for everyone involved. By combining these smart strategies, you can turn the SOC 2 process from a daunting expense into a manageable and predictable investment.

How to Choose the Right Auditor for Your Budget

Picking the right audit partner is one of the single biggest decisions you’ll make, directly impacting your final SOC 2 Type 2 audit cost. The firm you choose doesn’t just set the price; it shapes the entire experience. It can feel like a daunting choice, but it really boils down to understanding the trade-offs between the major types of audit firms out there.

You’re generally looking at two main camps: the massive, brand-name firms (often called the “Big Four”) and the smaller, more nimble boutique firms. Each offers a completely different mix of brand prestige, cost, and hands-on service. The key is to look past the logo and figure out what your business actually needs.

Big Four Firms vs. Boutique Auditors

Think of choosing an auditor like buying a car. A Big Four firm is the luxury SUV—it’s got a globally recognized brand, a massive footprint, and a price tag to match. For huge enterprises that need to flash that name for instant credibility with other global giants, they’re often the default. But that prestige can easily cost double or triple what other excellent firms charge.

A boutique firm, on the other hand, is like a modern, reliable sedan. It’s efficient, specialized, and gets the job done exceptionally well without the flashy badge and sky-high overhead. These firms live and breathe frameworks like SOC 2, giving you a more hands-on, flexible experience that’s a much better fit for most startups and mid-market companies.

Choosing an auditor isn’t just a procurement task—it’s a strategic partnership. The right firm should feel like an extension of your team, offering real guidance, not just a rubber stamp. You want a partner who gets your industry and your tech stack.

Running an Effective Selection Process

To find that perfect fit, you need to run a real process. Don’t just go with the first name that pops up in a search. A request for proposal (RFP) process with three to five firms will arm you with the data you need to compare apples to apples and make a smart decision.

When the proposals start rolling in, resist the urge to just scan for the lowest number. Here are the questions you need to ask to truly understand what you’re getting:

- Industry Experience: Have they audited companies like yours before? Ask them for specific examples of clients in your niche, whether it’s SaaS, FinTech, or HealthTech.

- Audit Methodology: How do they actually collect evidence? Are they stuck in the past with manual spreadsheets, or are they comfortable working with modern compliance automation tools?

- Team Composition: Who from their team will actually be doing the work? You want seasoned auditors, not a rotating cast of recent grads who are learning the ropes on your time and dime.

By digging into these areas, you can see past the bottom-line price. It’s also critical to understand the specific SOC 2 auditor requirements to ensure any firm you’re considering is properly licensed and qualified. This way, you’re not just picking a vendor—you’re selecting a partner that fits your budget and genuinely strengthens your security program.

Frequently Asked Questions About SOC 2 Costs

Jumping into the world of compliance always brings up a few key questions, especially around the budget. Here are some straight answers to the most common things we hear about SOC 2 costs.

Is a SOC 2 Type 1 Audit Cheaper Than a Type 2?

Yes, and by a pretty wide margin. A Type 1 report is just a snapshot—it checks if your controls are designed correctly on a single day. It’s less work for the auditor, so it costs less.

A Type 2, on the other hand, is a video. It tests how well those controls actually work over several months. This takes way more effort from the auditor, which is why the price tag is higher. Most companies start with a Type 1 to get a quick win, but your big customers will almost always demand the assurance that comes with a Type 2.

Do Compliance Automation Tools Replace an Auditor?

Nope. Think of them as a hyper-efficient assistant, not a replacement for the expert. Platforms like Vanta or Drata are fantastic for organizing your evidence, automating collection, and keeping you on track. They can absolutely reduce the manual grunt work, which often translates into lower audit fees.

But here’s the bottom line: The final SOC 2 attestation report must be issued by an independent, licensed CPA firm. These tools make the process smoother and more efficient, but the auditor’s independent sign-off is the entire point of the exercise. It’s non-negotiable.

How Often Do We Need to Renew a SOC 2 Report?

Plan on doing this every year. A SOC 2 report is generally only considered valid for 12 months.

This isn’t a one-and-done project you can check off a list. To keep your customers happy and your compliance status active, you need to budget for an annual audit. Smart companies treat SOC 2 as an ongoing operational expense, not a one-time capital investment.

Ready to find an auditor that fits your budget and timeline? At SOC2Auditors, we help you compare 90+ verified firms based on real pricing and timelines. Get three tailored matches in 24 hours—no spam, just data. Find your perfect SOC 2 auditor today.